One-time straight payment

How to Integrate

1 Obtain your API Keys

If you already have your API keys and know how to use it, you may proceed to the next step.

The Payments Processing Platform APIs uses API keys to authenticate requests. API keys carry many privileges, your grant or permission to access and integrate with Maya’s endpoints.

Step 1: Prepare your Public GPG Keys to be submitted to Maya. Don’t have keys yet? Learn How

Step 2: Provide email address of the nominated recipient of the API Keys.

Step 3: Credentials and keys will be received via an encrypted email. You should be able to decrypt it using your public and private GPG keys.

Different API keys will be provided for each environment: Sandbox or Production.

Authenticating with our API

Authentication is done via HTTP Basic Authentication. Depending on the API endpoint, the public (pk-....) or secret (sk-....) key must be provided as the username and the password left as blank.

Steps are as follows:

- Combine Username and Password (left blank) separated by ‘:’ (colon). If your API key is “pk-Z0OSzLvIcOI2UIvDhdTGVVfRSSeiGStnceqwUE7n0Ah”, the resulting string is:

pk-Z0OSzLvIcOI2UIvDhdTGVVfRSSeiGStnceqwUE7n0Ah:

- Apply Base64 encoding to the resulting string from Step 1. Using the resulting string from Step 1, the Base64 encoded string will be:

cGstWjBPU3pMdkljT0kyVUl2RGhkVEdWVmZSU1NlaUdTdG5jZXF3VUU3bjBBaDo=

- Indicate the authorization method i.e. “Basic” followed by a space then the Base64 encoded string in Step 2. An example is shown below.

Authorization: Basic cGstWjBPU3pMdkljT0kyVUl2RGhkVEdWVmZSU1NlaUdTdG5jZXF3VUU3bjBBaDo=

See also: HTTP Basic Auth

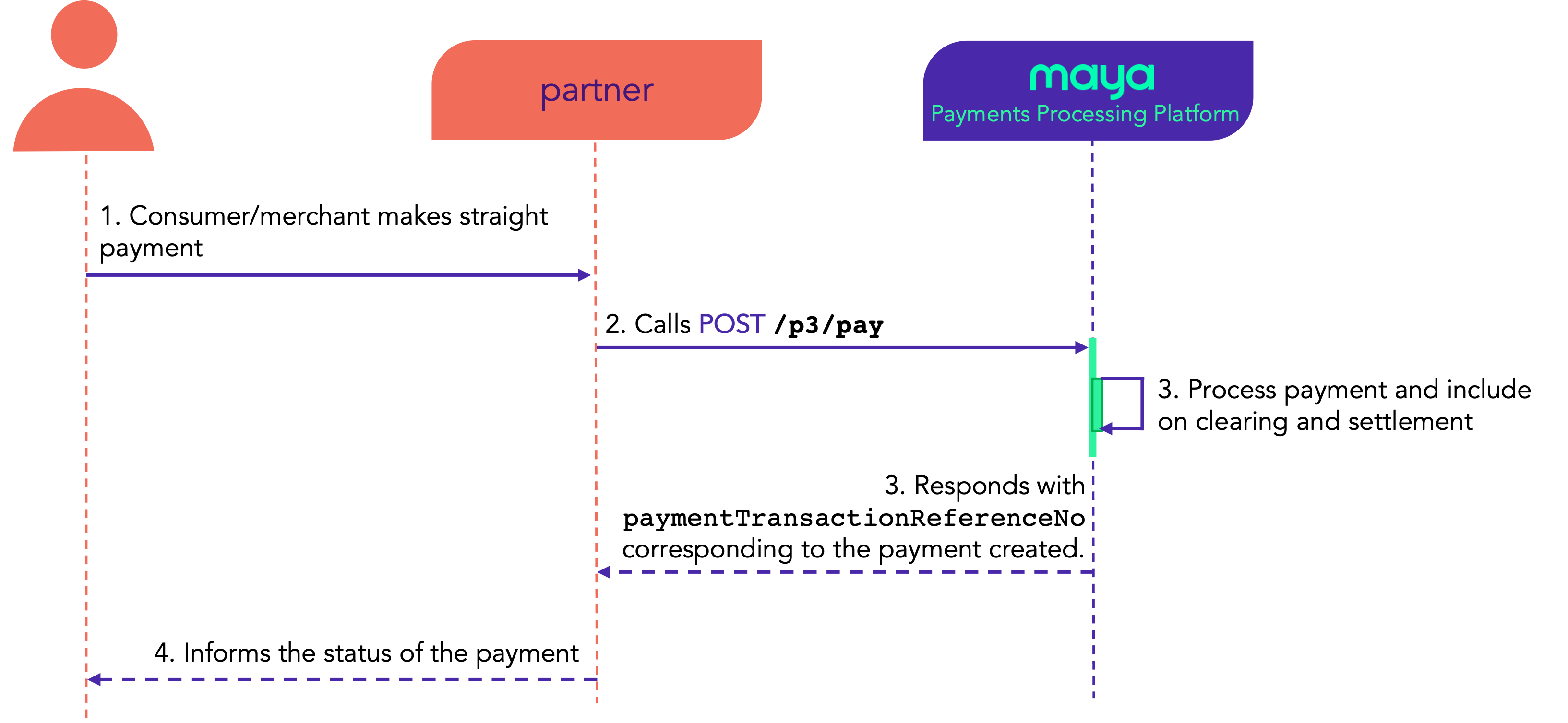

2 Create Straight Payment

Tips

It is highly recommended that you perform the 3D Secure or 3D Secure 2 (3DS or 3DS2) authentication to increase your success rate and prevent transaction from getting declined by the issuing banks.

You will be responsible for performing the 3D Secure or 3D Secure 2 (3DS or 3DS2) authentication leg, including, but not limited to, integrating with its own or a 3rd party Merchant Plug-in (MPI).

Use this endpoint and provide basic payment details when performing a straight payment.

- A successful straight payment request will generate a

paymentTransactionReferenceNo. - Successful straight payment will be processed for clearing and settlement on the next cut-off schedule.

Funding instrument must be set to indicate the type of source of funds or where payment will be charged. Payments Processing Platform currently supports fundingInstrument: CARD

When card is used, you need to indicate the account type and card type where the transaction should be charged.

| ACCOUNT TYPE

(Customer’s account type linked to the card) |

CARD TYPE

(Type of the card used at the point-of-sale) |

|

|---|---|---|

| DEBIT | CREDIT | |

| Default | ✅ | ✅ |

| Savings | ✅ | |

| Current | ✅ | |

| Credit | ✅ | |

For E-commerce

Click to see full details

Maya’s Payments Processing Platform supports authorizations for 3D Secure or 3D Secure 2 (3DS or 3DS2) authenticated e-commerce transactions. You may specify the result of the authentication in the threeDSecure object (by providing the verification token) to complete an authenticated transaction.

"threeDSecure":

{

"verificationToken": "jqEmJkhI2+SDCAAAAAAJBwAAAAA=",

"eci": "05",

"enrolled": "Y",

"authenticationStatus": "Y"

}

For Card-present

Click to see full details

Card-present transactions supports the following card entry methods:

- EMV: Contact Chip (Integrated-Circuit Card)

- EMV: Contactless Chip (Integrated-Circuit Card)

- Magnetic Stripe

- Contactless Magnetic Stripe

EMV (chip-based) transactions

For chip-based requests, the

emvIccDatacontains theBase64encoded value of the binary TLV chip data read from the card. For example, for the following TLV data:

82021C008407A0000000031010950580000000009A031704199C01005F2A0206089F02060000000001009F03060000000000009F1012060A0A03A080000A0200000000006E79F3999F1A0206089F1E0850594D59504F53319F26080E7F58B5275B72B19F2701809F33032020C89F34031E03009F3501219F360200CA9F3704A397A2559F4104000000019F6E0420000000

The resultingemvIccDatashould be:

ggIcAIQHoAAAAAMQEJUFgAAAAACaAxcEGZwBAF8qAgYInwIGAAAAAAEAnwMGAAAAAAAAnxASBgoKA6CAAAoCAAAAAABuefOZnxoCBgifHghQWU1ZUE9TMZ8mCA5/WLUnW3KxnycBgJ8zAyAgyJ80Ax4DAJ81ASGfNgIAyp83BKOXolWfQQQAAAABn24EIAAAAA==

Initiator and Intent

You can indicate the initiator and the intent of the transaction in the Straight Payment requests. The value in these fields may be used by Issuers when determining the approval status of an authorization transaction.

Recurring transactions (i.e., transaction.frequencyIndicator =

RECURRING)

These transactions will be treated as merchant-initiated transactions, regardless of the value oftransaction.initiator.

INITIATOR (transaction.initiator)

transaction.initiator)Click to see full details

The transaction initiator is the entity that initiated the authorization request. The following initiators are supported by the API:

Keep in mind

By default, transaction is treated as

CONSUMERinitiated if initiator was not specified.

CONSUMERDEFAULT |

Indicates that transaction is consumer initiated (e.g., consumer explicitly purchased an item from the merchant) |

MERCHANT |

Indicates that transaction is merchant initiated (e.g., charging subsequent miscellaneous fees after the original transaction) |

INTENT (transaction.intent)

transaction.intent)Click to see full details

Transaction intent is a general description of the purpose of the authorization request. The following intents are supported by the API:

Keep in mind

If intent is not specified, transaction will be, by default, intended for

PAYMENT.

PAYMENTDEFAULT |

Indicates that the authorization request is being done to collect payment from the consumer for goods/services rendered. |

VAULTING |

Indicates that the request intends to store the consumer’s credentials after a successful authorization.

Normally, authorizations with the VAULTING intent are voided/refunded afterwards, as the results are only used for validating the consumer’s credentials. This value should be set even if the client intends to collect payment from the authorization request as well, as long as the client intends to store the credentials afterwards. |

Reference Numbers

The following reference numbers can be set to provide additional tagging for each transaction during reconciliation processes:

In Request Header

|

In Request Body

|

|

Using Vaulted/Stored Credentials

Vaulted card transaction no longer contains the card security code (CSC). However, Issuers may decline transactions more often due to the lack of a secondary authentication mechanism (since both 3D Secure or 3D Secure 2 (3DS or 3DS2), and CSC validation are no longer performed).

Tips

Indicate that the credit card information of the transaction came from its storage by setting

payer.fundingInstrument.card.vaultedtotrue.

This will help relax the acceptance requirements of issuers, since it is assumed that you have already previously authenticated the cardholder by different means.

Conditional Void and Refund

Transaction retains only up to a period of

90 daysin its Sandbox environment and390 daysin its Production environment.

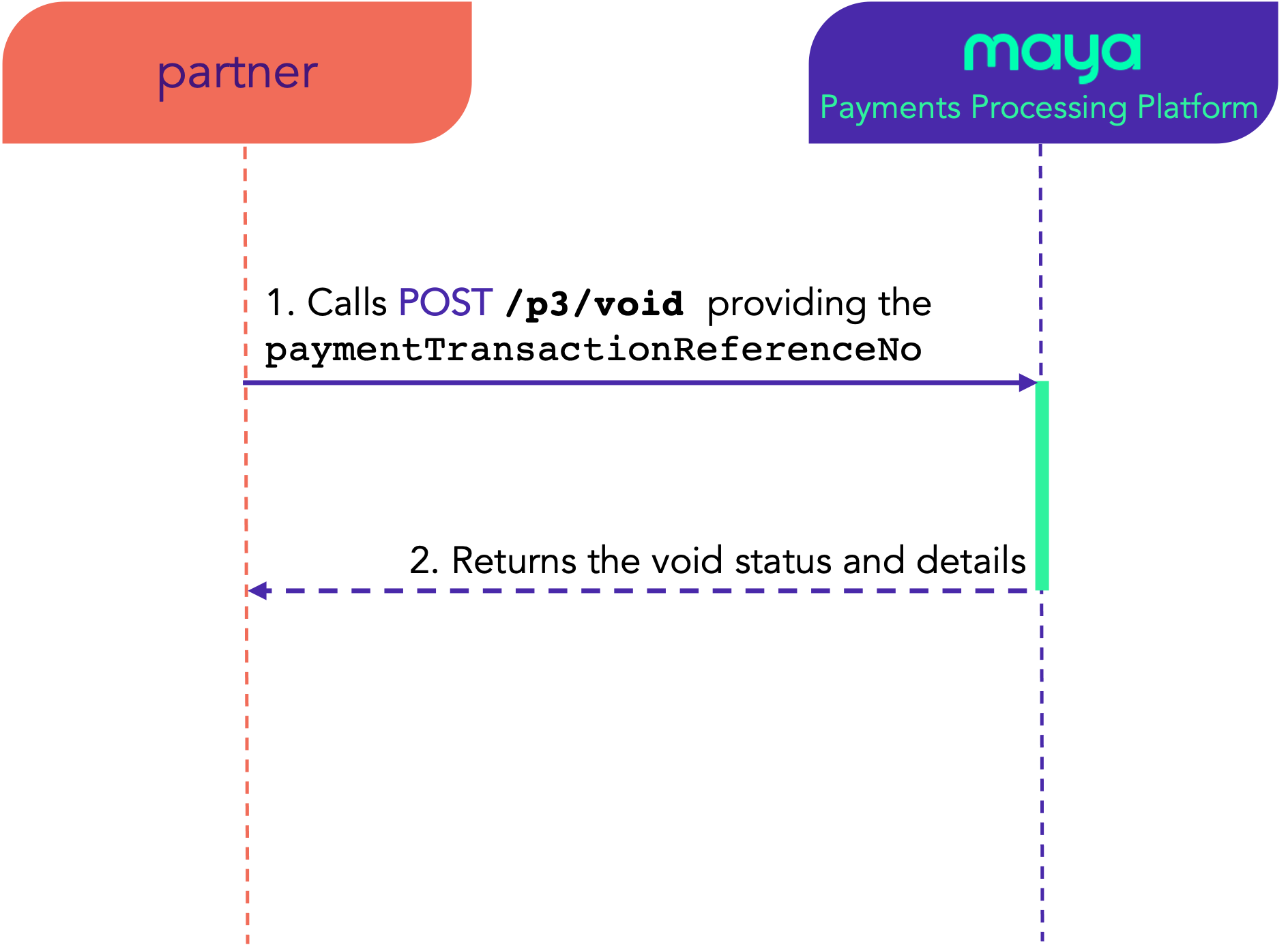

Void Transaction

Use this endpoint to void a successful transaction providing the paymentTransactionReferenceNo generated during creation of straight payment.

Keep in mind

You can only void straight payment done on or before

11:59:59 PM(PH Standard Time) cut-off of the same day as transaction date, otherwise refund is your option.

In case a response is not received by the API client (e.g., timeout or connectivity error occurred), the client may send a void request with the following fields from the previous purchase request:

paymentRequestReferenceNomerchantIdamountHowever, if

paymentTransactionReferenceNois already provided, the fields above are ignored.

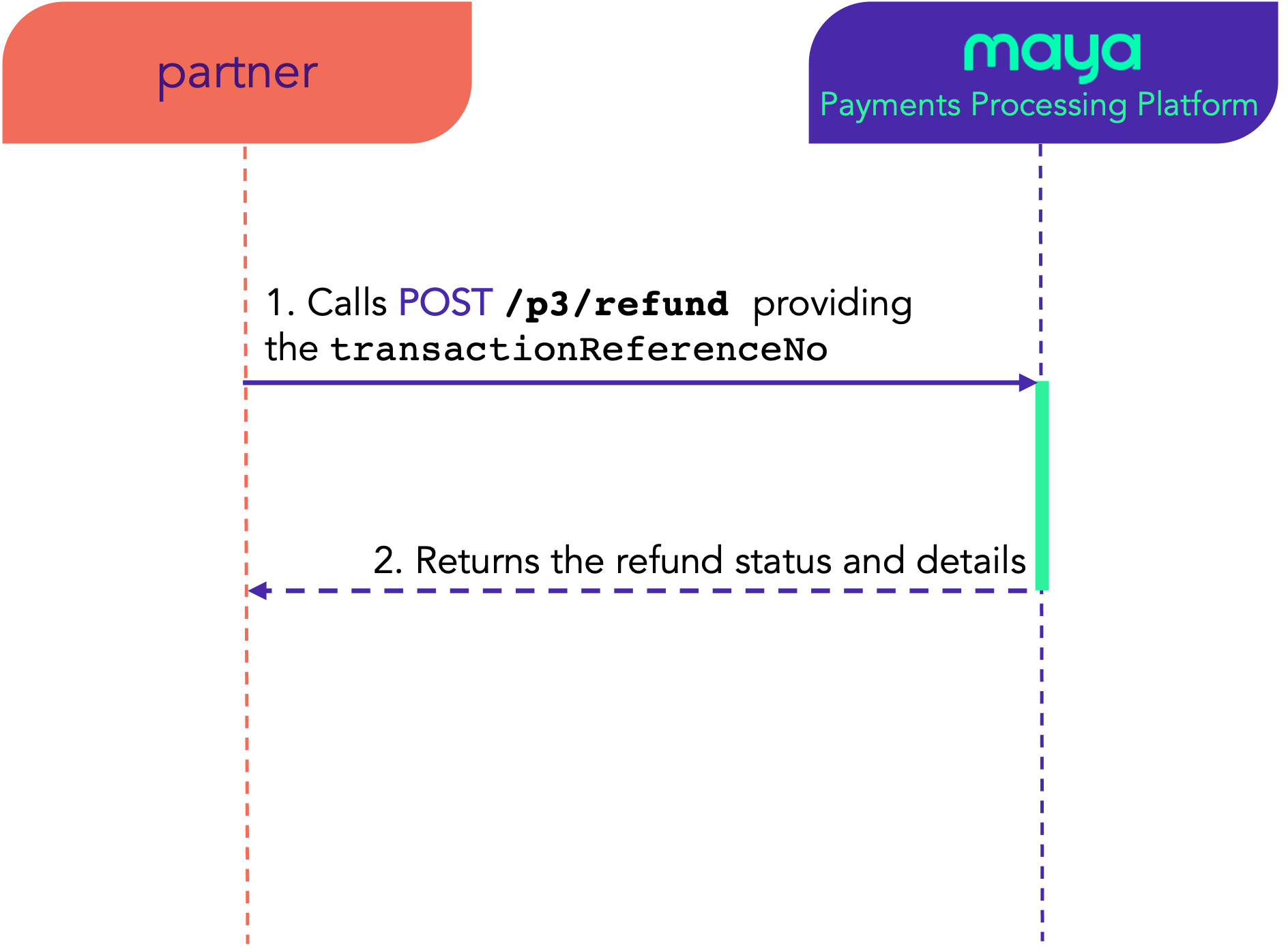

Refund Transaction

Use this endpoint to refund straight payment

Keep in mind

You can only refund straight payment after the

11:59:59 PM(PH Standard Time) cut-off, otherwise, use void.

Clients can perform either full or partial refunds.

Full Refunds

- You just need to provide the

transactionReferenceNoof the transaction to refund the full amount.

Partial Refunds

- You need to provide

transactionReferenceNoand theamountto be refunded. You may continue to send partial refund requests until the entire amount for the transaction has been refunded.

You can do multiple and partial refunds for a straight payment, as long as the total refund amount does not exceed the full amount of the transaction.

3 Test your Work

Test your services by simulating transactions in our sandbox environment. You may use the test accounts available in Sandbox Test Credentials and Cards  .

.

Tips

Use the Transaction Inquiry endpoints

to track and monitor your transactions.

If you're experiencing server errors or timeouts, check the Sandbox Health Page for real-time updates on service status. If an outage is indicated, rest assured that our team is already on it, working to restore services as soon as possible.

Updated 12 months ago